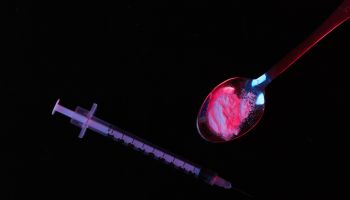

When homeowners are behind on their mortgage payments, or attempting to modify their home loan, or even on occasion fully paid up but lost in the bureaucratic shuffle, they are in danger of having their home broken into and their possessions removed by the banks.

A New York Times report details the occasional terrible mistakes banks have made with their customers in the mortgage crisis mess, breaking into the homes and changing the locks of peCople who were far from deserving of such punishment.

While banks claim the break-in mistakes are an anomaly involving a few dozen examples among millions of mortgage holders, the effects on those who endure the humiliation have resulted in both emotional turmoil and the occasional big lawsuit settlement.

VIDEO:

![]()

In Truckee, Calif., Mimi Ash was behind on her mortgage payments on her vacation home, but in the process of working out a loan modification. Regardless, Bank of America sent contractors to her house to change the locks and clear out her house, and they removed clothes, kids’ medals, and her dead husband’s ashes, according to the Times. Ash has since filed a federal lawsuit.

The report details several other cases as well:

Alan Schroit had stored 75 pounds of frozen fish caught on an Alaskan vacation in his Galveston, Tex., second home, only to have the bank change the locks and shut off the electricity, even though he was caught up in his mortgage payments. The resulting disaster to the house itself from the melting fish ended in a settlement for Schroit.

In Florida, contractors working for Chase Bank used a screwdriver to enter Debra Fischer’s house in Punta Gorda and helped themselves to a laptop, an iPod, a cordless drill, six bottles of wine and a frosty beer, left half-empty on the counter, according to assertions in a lawsuit filed in August. Ms. Fisher was facing foreclosure, but Chase had not yet obtained a court order, her lawyer says.

A clause in most mortgages allows banks that service the loan to enter a home and secure it if it is in default, meaning if the mortgage payment is 45 to 60 days late, and if the house has been abandoned, authorities said.

Read entire article at CBSnews.com

Share this post on Facebook! CLICK HERE: http://widgets.fbshare.me/files/fbshare.js

Shaq dumps fiancee Hoopz [from Hellobeautiful.com]

Bikini model’s hair catches on fire at Diddy’s

album release[from Hellobeautiful.com]

Behind the scenes of video of Lil Kim’s Nicki Minaj diss

[from TheUrbanDaily.com]

Tyler Perry snubbed by SAG [from

Theurbandaily.com]